In This Report:

- NAVSEC Reveals Welding Failures By Newport News Shipyard

- U.S. Cannot Build Three Destroyers Per Year

- GAO: Poor Shipbuilding Quality Causes Increased Cannibalization of U.S. Navy Ships

- Other U.S. Naval Shipbuilding Problems

- CSIS: Superior Chinese Shipbuilding Is Driving Chinese Naval Supremacy

- China’s Shipbuilding Continues To Gain Ground In 2024

- Conclusion

By Stas Margaronis & Kevin Policarpo

The United States is facing a growing crisis in naval shipbuilding that has gotten so bad that the U.S. Navy can no longer rely on competent welding of vessels.

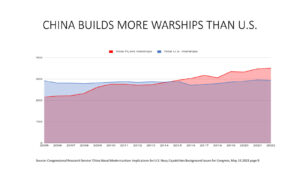

In 2024, the Congressional Research Service reports that China is outpacing the United States Navy in new ships: “The… overall battle force [of China’s navy] is expected to grow to 395 ships by 2025 and 435 ships by 2030. The U.S. Navy, by comparison, included 296 battle force ships as of August 12, 2024, and the Navy’s FY2025 budget submission projects that the Navy will include 294 battle force ships by the end of FY2030. U.S. military officials and other observers are expressing concern or alarm regarding the pace of China’s naval shipbuilding effort, the capacity of China’s shipbuilding industry compared with the capacity of the U.S. shipbuilding industry, and trend lines regarding the relative sizes and capabilities of China’s navy and the U.S. Navy.”[1]

NAVSEC Reveals Welding Failures By Newport News Shipyard

On September 24, 2024, U.S. Secretary of the Navy, Carlos del Toro, admitted to Congress that there have been widespread welding failures that have impacted a number of U.S. Naval vessels:

“Last Tuesday, 24 September, I learned that Huntington Ingalls Industries (HII) – Newport News Shipbuilding (NNS) found potential deficiencies with welds on in-service and new construction U.S. Navy submarines and aircraft carriers. | have discussed the seriousness of this matter with the HII CEO. NNS reports that the issues involve welders who did not follow welding procedures properly. While I am deeply disappointed about this failure to uphold quality on the part of the shipyard as required by contract, my top priority is ensuring the safety of our Sailors and platforms and communicating transparently with the Congress and the American people. The safety of our Sailors and ships is of paramount importance…

As of today, the Navy has identified three in-service ships that are affected by this welding deficiency: USS GEORGE WASHINGTON (CVN 73), USS HYMAN G. RICKOVER (SSN 795), and USS NEW JERSEY (SSN 796). Importantly, the Naval Sea Systems Command (NAVSEA) has assessed that the welds were not on components or systems that affect ship safety or operations. NAVSEA, as the technical warrant holder, has determined the ships are safe to operate.

NNS and Navy technical experts are progressing in the validation and remediation of specific welds on approximately 23 new construction, Refueling Complex Overhaul (RCOH), and ships in maintenance. This process involves assessing each weld to determine the degree of deficiency through a joint-by-joint analysis. To assess potential risks to our new construction ships, NNS and the Navy are conducting an evaluation together using proven protocols and a team of senior structural and welding engineers…”[2]

Newport News Shipyard President Jennifer Boykin, posted on LinkedIn, the discovery of the defective welds and subsequent actions taken:

“Today, I have very serious and disappointing news to share with you. We recently discovered that the quality of certain welds on submarines and aircraft carriers under construction here at NNS do not meet our high-quality standards. Most concerning is that some of the welds in question were made by welders who knowingly violated weld procedures.

Fortunately, this issue was brought to light by shipbuilders who did the right thing and came forward by either self-reporting or calling the HII OpenLine. I thank them for their honesty and bravery.

We have to remember our nation depends on us to deliver the highest quality ships, as do the moms, dads, spouses and children of our Navy sailors who live aboard them. Let me be clear: we do not tolerate any conduct that compromises our company’s values and our mission of delivering ships that safeguard our nation and its sailors.

Once our investigation confirmed the validity of these reports, we immediately put together a team made up of both internal and independent engineering and quality subject matter experts to determine the root causes, bound the issue and put in place immediate short-term corrective actions as we work through longer-term solutions. We also notified the Department of Justice, our shipbuilding partner, Navy customer, and regulators, and are providing them with regular updates to ensure transparency and alignment.

I cannot over stress that individual actions and behaviors either strengthen – or weaken – our ethical culture in an instant. Every choice you make as a shipbuilder has long lasting impact. Ask for help when you are unsure. And speak up if you see questionable behavior or actions by others. Speak to your supervisor or report it, 24/7…”[3]

In an internal memo to senior Navy leaders, Assistant Secretary of the Navy for Research, Development and Acquisition Nickolas Guertin stated that HII reached out to the DoJ, with parts of the memo being released on social media and causing accusations of the poor welds being made purposefully.

However, U.S. Naval Institute News (USNI) received word from several sources that the accusations of purposeful sabotage by the workers at HII was inaccurate and no evidence of such actions exist.

In a separate statement to USNI News, HII stated that while the shipyard workers had indeed violated the welding rules, they did not have “malicious intent” to damage the submarines or aircraft carriers they were working on:

“We discovered through internal reporting that some welders knowingly circumvented certain welding procedures. Based on our initial investigation, there is no indication of malicious intent…”[4]

The discovery of faulty welds on U.S. ships is not a recent phenomena. Twice in the 2000s, the Navy mounted separate investigations into suspicious welds into then Northrop Grumman-managed Newport News Shipbuilding. In 2007, the Navy found welders used the wrong filler material in non-nuclear piping on Virginia-class submarines. In 2009, the Navy had to reinspect the welds on nine submarines and four aircraft carriers after a shipyard inspector admitted to falsifying inspection reports, according to The Virginian Pilot.[5]

U.S. Cannot Build Three Destroyers Per Year

In 2023, Under Secretary of Defense Mike McCord, the Pentagon’s top budget officer said U.S. shipyards do not have the capability to produce even two destroyers per year.

This statement comes at a time where China has surpassed the U.S. Navy in ship numbers and is continuing to expand its Naval forces.

Speaking to the U.S. Naval Institute News, McCord said: “I’m not hating on DDGs (Destroyer, Guided Missile) – my only point was that last year Congress added a third and the reason we didn’t budget for three is, again, we don’t see the yards being able to produce three a year. We don’t see them being able to produce two a year. And that’s just data. It’s not what we wish to be true. But everybody’s struggling with skilled labor. Everybody’s struggling with supply chain. So it’s not getting better very fast from the data that I’ve seen – whether with submarines or DDGs. So two a year seems to be a reasonable place…”[6]

Destroyer Shortage

McCord stated that the U.S. shipbuilding industry is currently building 1.5 destroyers per year at a time when the shipyards are struggling with a limited industrial base.

The U.S. Navy has fallen on challenging times. U.S. shipyards are not sufficiently supported and quality standards have fallen. This state of malaise in U.S. shipbuilding has resulted in new ships being constructed with design flaws, unreliable technology, and causing some U.S. naval vessels to be cannibalized in order to keep others afloat.

McCord also argued that additional funding to making an extra destroyer per year isn’t a wise use of resources to push shipbuilders to deliver sooner:

“It’s just sort of piling up in the orders book and we’re still going to have the same problems of the yards producing faster until we get through the supply chain and the workforce issues… It is not to say that we would not be interest[ed] in a more robust production world where in having three DDGs or moving to three submarines, but it doesn’t seem to be … realistic.”

McCord argued that providing additional funding is not the solution:

“If you keep sort of placing orders for things faster than they can be delivered, it’s good for the books, the balance sheets of the companies. But are you really, as the buyer, are you in the best place you’d like to be with any leverage or are you actually short of leverage when, you produce on time or you don’t produce on time. It doesn’t matter to me – I’m going to keep writing you checks…”[7]

Kimberly Aguillard, a spokeswoman for Huntington Ingalls Industries Shipbuilding, which constructs Arleigh Burke-class destroyers, spoke with USNI News about HII’s position on the matter:

“Our shipbuilders will position to support whatever destroyer cadence the Navy needs and we have started by building, testing and taking the first Flight III ship to sea, which will be delivered later this year. We are a committed partner to not only our customers but to our network of nearly 1,200 suppliers as well. Together, we can build three DDGs a year if that is what the Navy and our country need…”[8]

David Hench, a spokesperson for General Dynamics Bath Iron Works in Maine told USNI News:

“We support the call for a consistent demand signal that gives shipyards and suppliers the predictability to make major investments in workforce and facilities, both to expand destroyer production and to ensure that capability remains intact well into the future… Those capital investments are currently underway in Bath, and we are confident there will be significant schedule improvement so we can meet the Navy’s expectations by the time construction begins on the anticipated multi-year contract.”[9]

Lawmakers are pushing the Navy to purchase three destroyers per year “… and added a third destroyer on top of the Navy’s request for two in FY 2023.”[10]

Despite the pressure from Congress, the Navy is sticking to buying two destroyers a year because as McCord explained: “We would love to live in a world where the yards could make three a year, or three submarines a year, but we don’t live in that world…”[11]

GAO: Poor Shipbuilding Quality Causes Increased Cannibalization of U.S. Navy Ships

The issue of work quality in U.S. naval shipbuilding is so bad that U.S. naval vessels are routinely cannibalized in order to keep other vessels from breaking down.

In 2023, the U.S. General Accounting Office, the investigative arm of Congress issued a report: Weapon System Sustainment: Navy Ship Usage Has Decreased as Challenges and Costs Have Increased which found:

“From FYs 2011-2021, the 10 Navy ship classes we reviewed faced persistent and worsening challenges including a decrease in the number of hours a ship is available for operations or training.

These challenges included:

- An increase in the number of working ship parts removed and used elsewhere due to parts shortages

- An increase in casualty reports—i.e., reports of events that impair a ship’s ability to do its job

- An increase in maintenance delays”[12]

The GAO also reported: “We have made dozens of recommendations to address these issues, but the Navy has yet to fully implement them all.”[13]

In more detail the GAO said:

“GAO reviewed key sustainment metrics for 10 ship classes and found that from fiscal years 2011 through 2021, these classes faced persistent and worsening sustainment challenges. Specifically, the number of maintenance cannibalizations (working parts removed and reused elsewhere due to parts shortages), casualty reports (reports of events that impair ships’ ability to do a primary mission), and days of maintenance delay (days beyond the scheduled end date for depot maintenance) have each increased, while steaming hours (the number of hours a ship is generally in an operating or training status) have decreased. Additionally, the Navy is not fully or accurately tracking other metrics—operational availability and materiel availability—that the Department of Defense and the Navy have determined are key to assessing ship effectiveness despite a prior GAO recommendation to do so.”[14]

Other U.S. Naval Shipbuilding Problems

Following the end of the Cold War, the U.S. government began downsizing the defense industry. To stay relevant, the industry adapted and consolidated. Since 1993, in terms of shipyards, the number of public shipyards used by the Navy went from 8 to 4.[15]

However, these shipyards have “…limited functional dry docks, old equipment, and regularly delay maintenance for the submarine and aircraft carrier fleets.”[16]

Since the 1960s, three shipbuilders had left the industry and only one shipyard has opened. General Dynamics and Huntington Ingalls Industries (HII), the two largest shipbuilders in the U.S., “…reported a record new construction backlog for 2020 competing for drydock space with essential ship maintenance.”[17]

Additional attention also has to be given to private shipyards, which construct and maintain most of the current fleet, from fleet oilers to destroyers. According to National Defense, the main challenges for private shipbuilders are personnel shortages, increasing costs of materials, and inconsistent acquisition priorities.

In terms of skilled technicians, the U.S. is suffering a decrease of personnel. Since the 1990s, the skilled members of the workforce are getting older, leaving the shipyards with workers that lack the necessary experience. The lack of skilled technicians have caused “… delays in construction and maintenance, compromising the Navy in a possible future engagement.”[18]

Rising costs of materials is another problem for shipbuilders. The Congressional Budget Office (CBO) found that the shipbuilding cost index for the Navy was 1.2% higher than overall economic inflation between 1986 and 2009.[19]

An example of rising cost is cited in a Bloomberg report published on February 20th, 2023, which noted the failure of the Littoral Combat Ship (LCS). The Pentagon’s strict requirements and the small number of available contractors contributed to many defense projects going over budget, including the LCS. Originally, the Navy requested a fleet of 55 LCSs, with each ship costing $220 million. Due to cost overruns, the fleet shrank to 35 ships with each ship costing $478 million apiece.[20]

CSIS: Superior Chinese Shipbuilding Is Driving Chinese Naval Supremacy

The Washington, D.C. based Center for Strategic and International Studies published a report, Unpacking China’s Naval Buildup, which warns that the United States Navy is falling further and further behind China.

“China now possesses the world’s largest maritime fighting force, operating 234 warships to the U.S. Navy’s 219. This count of China’s fighting ships encompasses all of its known, active-duty manned, missile- or torpedo-armed ships or submarines displacing more than 1,000 metric tons, including the 22 missile-armed corvettes recently transferred to the China Coast Guard but not the approximately 80 missile-armed small patrol craft operated by the PLAN. The oft-cited count of about 290 U.S. Navy “battle force ships” includes combat logistics and support vessels, of which the U.S. Navy has 126, including those under the Military Sealift Command, and the PLAN 167, according to the International Institute for Strategic Studies.”[21]

CSIS explains that such dominance provides an important wartime advantage: “one recent study concluded that larger fleets won 25 out of 28 historical wars. Like those historical combatants, China has the numbers to absorb more losses than the United States and keep fighting. In one recent set of wargames, China lost 52 major surface warships compared to between 7 and 20 U.S. equivalents. Even after such catastrophic losses, China still had more surface warships than the United States and was able to continue the naval battle.”[22]

On the plus side, the analysis says that the United States continues to hold an advantage in guided missile cruisers and destroyers: “Destroyers in particular serve as the backbone of any modern fleet due to their multi-mission capabilities, speed, and cruising range. The United States’ 73 destroyers allow it to exert sea control and project power to a greater extent than do the PLAN’s 42 destroyers. But China is closing the gap, having doubled its destroyer fleet from 20 in 2003 to 42 in 2023. The PLAN operates 23 destroyers launched in the past 10 years compared with 11 operational U.S. destroyers. China has also launched eight cruisers since 2017, while the United States has not launched a new cruiser since 2016.”[23]

The U.S. preponderance of cruisers and destroyers may also be a distraction from the Chinese advantage in frigates and corvettes: “These smaller ships played a key role in World War II, in which they served as convoy escorts, fleet protection vessels, and radar picket ships. In a modern conflict, they might serve similar roles, fight enemy ships in the Indo-Pacific’s littoral waters, or perform other missions that naval strategists have not yet foreseen. The U.S. Navy appears to recognize that it might be overinvested in larger cruisers and destroyers: statements by senior U.S. Navy personnel have emphasized the need to rapidly increase frigate production. Both the United States and China are also seeking to develop armed naval surface and underwater systems smaller than China’s manned corvettes. Smaller ships may not be as powerful as larger ones, but they can be built faster and in greater numbers.”[24]

The CSIS report echoes the efforts of U.S. Navy Secretary Carlos Del Toro who has urged closer cooperation between the United States, Japan and South Korea to meet the Chinese threat:

“The United States probably faces insurmountable obstacles to meaningful increases in shipbuilding in the coming decade, but it might be able to reduce China’s advantage through its relationships with Japan and South Korea. These U.S. partners accounted for 26 and 14 percent of global ship deliveries in 2023, respectively. The U.S. Navy plans to repair ships at international shipyards in 2025 on a trial basis, which could reduce the maintenance backlog, but actually constructing U.S. ships using foreign shipbuilders is unlikely due to U.S. legal restrictions. The only long-term answer is probably an industrial strategy that supports the broader U.S. shipbuilding sector for decades…U.S. partners can help overcome China’s numerical advantage. The Japanese Maritime Self-Defense Force operates 4 cruisers, 34 destroyers, 10 frigates, and 4 helicopter carriers, two of which will soon be capable of launching and recovering F-35s. The South Korean navy operates 3 cruisers, 6 destroyers, 16 frigates, and 5 corvettes. If either navy fights alongside the United States, the PLAN will lose its numerical advantage. But effectively integrating U.S. and partner forces is difficult, and whether these nations will fight alongside the United States is beyond the control of U.S. defense planners. Solving the problem therefore depends both on strengthening U.S. partnerships and building a larger U.S. Navy.”[25]

The CSIS report says China’s overwhelming supremacy as a world class shipbuilder, that can mass-produce quality commercial and naval ships, is driving the growing supremacy of the People’s Liberation Army Navy:

“China’s productive advantage is reflected in the relative ages of active Chinese and U.S. ships. About 70 percent of Chinese warships were launched after 2010, while only about 25 percent of the U.S. Navy’s were. China’s newer ships are not necessarily superior, although the U.S. Office of Naval Intelligence assessed in 2020 that China’s ships were increasingly of comparable quality to U.S. ships.”[26]

Chinese ship production dwarfs that of the United States: “The Office of Naval Intelligence assessment noted that China has “dozens” of commercial shipyards larger and more productive than the largest U.S. shipyards, and an unclassified U.S. Navy briefing slide suggested that China has 230 times the shipbuilding capacity of the United States. China’s massive shipbuilding industry would provide a strategic advantage in a war that stretches beyond a few weeks, allowing it to repair damaged vessels or construct replacements much faster than the United States, which continues to face a significant maintenance backlog and would probably be unable to quickly construct many new ships or to repair damaged fighting ships in a great power conflict… This enormous shipbuilding capacity means that PLAN expansion will remain a feature of U.S.-China strategic competition as long as the Chinese economic and personnel systems can support it—and the Chinese Communist Party leadership deems it important. How big the PLAN will grow is unknown: unlike the United States, China does not publish its shipbuilding plans. U.S. defense planners should assume that the PLAN will continue to grow—potentially at an accelerating pace—in number, ship size, and firepower. The challenge faced by the U.S. Navy and the maritime forces of like-minded nations is only beginning.”[27]

Another problem is the over-dependence on the U.S. Navy on aircraft carriers:

“Some analysts argue that China’s numerical advantages are literally outweighed by the U.S. Navy’s much larger ships. Because bigger ships can move farther and carry more weapons and support systems than smaller ships, the U.S. Navy’s advantage in displacement suggests that China still trails the United States in its ability to fight at sea. The extent of the U.S. advantage depends greatly on the utility of aircraft carriers in a naval conflict. U.S. aircraft carriers and amphibious assault ships (some of which can serve as “mini-carriers”) account for about 90 percent of the displacement gap. But carriers’ utility in a navy-on-navy fight is hotly debated. If carriers turn out to be of limited value for modern naval warfare, much of the U.S. displacement advantage disappears, and recent rates of expansion suggest that China can probably surpass the United States in aggregate displacement of cruisers, destroyers, and frigates in less than ten years.”[28]

China’s Shipbuilding Continues To Gain Ground In 2024

(Photo: CSIS & Maxar Tecnologies)

Center for Strategic and International Studies (CSIS) report entitled “In the Shadow of Warships: How foreign companies help modernize China’s navy.” provided this commercial satellite imagery above taken at the Jiangnan shipyard on February 21, 2022, when the Chinese aircraft carrier (left) and Evergreen container (ship) were sited together, also found that at least three Evergreen hulls were under construction “… near China’s Type 003 aircraft carrier (i.e., the Fujian).

As U.S. naval shipbuilders struggle to weld ships and build ships, China’s shipbuilding industry made significant gains in the first half of 2024, with revenue and profits rising as the country secured almost 75 percent of new global orders, according to a July 2024 report in Global Times.[29]

The Global Times is a daily newspaper operating under the auspices of the Chinese Communist Party’s flagship newspaper, the People’s Daily,

The report states that: “Rising global demand played a part, experts said, but China’s technological advancements are the cornerstone of its rapid development. These achievements show the country’s efforts to enhance its manufacturing capabilities and develop new quality productive forces.”[30]

According to the report, Chinese “…ship completions rose 18.4 percent year-on-year to 25.02 million deadweight tons (dwt), making up 55 percent of the global total in the first half, data from the Ministry of Industry and Information Technology showed. The industry also saw an increase in order backlogs, which rose 38.6 percent to 171.55 million dwt. China takes the lead globally in 14 out of 18 major ship types in terms of new orders, an indicator of its dominant position in the market…”[31]

Zheng Ping, Chief Analyst from industry news portal chineseport.cn noted the factors that allowed for the high-speed development of Chinese shipbuilding:

“The rapid progress in Chinese shipbuilding stems from multiple factors, including advances in shipbuilding technology, increased demand from the global shipping market, and the high quality and efficiency of Chinese-made vessels…China has made significant technological breakthroughs in various shipbuilding sectors, from liquefied natural gas carriers to cruise liners. Better shipbuilding technologies and experiences in construction, coupled with process optimization and digital tools, have shortened construction cycles and improved quality, boosting competitiveness and profits…”[32]

The Ministry of Industry and Information Technology noted the robustness and profitability of the shipbuilding industry: “…total profits for the first five months of the year reaching 16 billion yuan ($2.2 billion), up 187.5 percent year-on-year…”[33]

Conclusion

In 2024, the Congressional Research Service reports that China is outpacing the United States Navy in naval shipbuilding: “The… overall battle force [of China’s navy] is expected to grow to 395 ships by 2025 and 435 ships by 2030. The U.S. Navy, by comparison, included 296 battle force ships as of August 12, 2024, and the Navy’s FY2025 budget submission projects that the Navy will include 294 battle force ships by the end of FY2030. U.S. military officials and other observers are expressing concern or alarm regarding the pace of China’s naval shipbuilding effort, the capacity of China’s shipbuilding industry compared with the capacity of the U.S. shipbuilding industry, and trend lines regarding the relative sizes and capabilities of China’s navy and the U.S. Navy.”[34]

In 2024, the Republican and Democratic-authored, Congressional Guidance for a National Maritime Strategy, said the United States maritime industry has suffered from “decades of neglect” allowing China to take the lead: “Decades of neglect by the U.S. government and private industry has weakened our shipbuilding capacity and maritime workforce, contributing to a declining U.S.-flag shipping fleet to bring American goods to market and support the U.S. military during wartime. Moreover, the People’s Liberation Army Navy and the merchant marine and maritime militia of the People’s Republic of China [PRC] outnumber the U.S. Navy. For decades, our country has failed to invest in critical maritime infrastructure and capabilities.”

One of the report’s co-authors, Senator Marco Rubio (R-FL) explained: “The competition between the United States and Communist China will define the 21st century, and nowhere is this conflict more prevalent than in the maritime domain. The U.S. must move quickly to revitalize our maritime industrial base, reinvest in a robust workforce, and advance innovative technologies to project strength and security in the world’s waterways, oceans, and seas.”

The report’s concerns were echoed by Jennifer Carpenter, CEO of the American Waterways Operators and President of the American Maritime Partnership who wrote: “The United States must renew its commitment to a strong, reliable American maritime capability to confront emerging threats. China’s aggressive shipping expansion poses significant challenges to the United States and our allies.”[35]

FOOTNOTES

[1] https://www.everycrsreport.com/reports/RL33153.html

[2] https://www.documentcloud.org/documents/25194942-241003-secnav-letters-to-congress-on-welds

[3] https://www.linkedin.com/posts/nnspresident_today-i-have-very-serious-and-disappointing-activity-7245464252256337920-2vK6/

[4] Ibid.

[5] https://www.pilotonline.com/2009/06/08/more-welding-woes-uncovered-for-newport-news-shipyard/

[6] Mallory Shellbourne, OSD Comptroller Says U.S. Shipyards Can’t Build 3 Destroyers a Year, March 21, 2023,https://news.usni.org/2023/03/21/osd-comptroller-says-u-s-shipyards-cant-build-3-destroyers-a-year

[7] Ibid.

[8] Ibid.

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12]https://www.gao.gov/products/gao-23-106440?utm_medium=social&utm_source=twitter&utm_campaign=usgao

[13] Ibid.

[14] Ibid.

[15] Heberto Limas-Villers, Improving the Shipbuilding Industrial Base, Published January 21, 2022, nationaldefensemagazine.org, https://www.nationaldefensemagazine.org/articles/2022/1/21/improving-the-shipbuilding-industrial-base

[16] Ibid.

[17] Ibid.

[18] Ibid.

[19] Ibid.

[20] Peter Marin, Courtney McBride and Roxana Tiron, Russia’s War on Ukraine, China’s Rise Expose US Military Failings, Published February 20, 2023, bloomburg.com, https://www.bloomberg.com/news/features/2023-02-21/pentagon-dod-actions-spark-concern-if-us-military-equipped-for-war

[21] https://www.csis.org/analysis/unpacking-chinas-naval-buildup

[22] Ibid.

[23] Ibid.

[24] Ibid.

[25] Ibid.

[26] Ibid.

[27] Ibid.

[28] Ibid.

[29]https://www.globaltimes.cn/page/202407/1316147.shtml#:~:text=China’s%20shipbuilding%20industry%20made%20significant,growing%20momentum%20of%20Chinese%20manufacturing

[30] Ibid.

[31] Ibid.

[32] Ibid.

[33] Ibid.

[34] https://www.everycrsreport.com/reports/RL33153.html

[35] https://www.ajot.com/insights/full/ai-the-united-states-needs-pacific-rim-collaborations