By Stas Margaronis

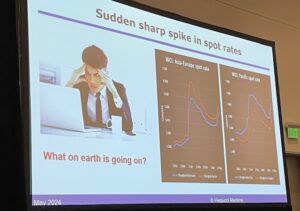

Lars Jensen, CEO at Vespucci Maritime based in Copenhagen, warned U.S. agricultural exporters that skyrocketing spot freight rates in 2024 could continue for the foreseeable future as vessels continue to be diverted away from the Suez Canal.

Jensen noted that ocean container spot rates from Shanghai to New York rose from around $2,500 in December to nearly $6,000 in May. Rates from Shanghai to Los Angeles rose from $2,000 to around $4,500 over the same period.

Other factors that are impacting rates are: port congestion in Asia, a possible Canadian rail strike and concerns about longshore labor negotiations on U.S. Atlantic and Gulf coast ports.

Jensen spoke to the Agriculture Transportation Coalition (AGTC) Annual Meeting at Tacoma, Washington on May 22nd where he said: “We have growing problems with port congestion in Asia. …. We do not have enough vessel capacity to deal with both the Red Sea and the port congestion …. It’s a simple fact.”

Red Sea Attacks

The need for ocean carriers to deploy all available shipping is necessary to divert away from the Suez Canal due to attacks on vessels in the Red Sea. This forced ocean carriers to sail ships around the coast of Africa which takes longer to reach European ports and U.S. East and Gulf coast ports. New ships, launched in 2023, needed to be dispatched to meet demand challenges.

Jensen warned that if Red Sea attacks on shipping are prolonged, then maximum shipping deployments could cause supply chain disruptions and keep freight rates high in a manner last seen during the Pandemic:

“At least anecdotally we are looking at a demand spike of something like 10%, 15%, 20%. This is a major problem. Why are the carriers pulling capacity out of Europe? Why are they not increasing capacity more in the Transpacific …How much blank sailing or capacity was taken out? … The answer is a lot. And let me then address something I’ve seen misinterpreted time and time again. Why are carriers blanking sailings? … Depending on market conditions right now the honest truth is every single ship that can sail is out sailing. There are none to be had. So, if a ship is basically a week delayed due to port congestion, the carrier has no choice but to blank a sailing … The reality is all of these blank sailings that we are seeing now are purely due to the inability to have any more vessels put in. This is Pandemic level territory.”

U.S. Exporters Face Higher Freight Rates

The result is that U.S. exporters are likely to be faced with higher freight rates in 2024: “The Pandemic hit us and … imports grew a lot more than exports and at the same time import freight rates grew a lot more than export freight rates. So, during the Pandemic we were down to around 4% of the revenue (that) was paid for by the exporters, 96% was paid for by the importers … I’m not surprised the carrier …looks at it, I think in any business you look and say: ‘I have two customers and I have a capacity constraint. I can’t necessarily serve both customers. One is paying 96% of my revenue, one is paying 4% of my revenue.’ Who would I choose to focus on? That’s pretty much a no brainer.”

Jensen warned AGTC members that even with improved protections for U.S. shippers and exporters under the Ocean Shipping Reform Act (OSRA), exporters will be faced with the reality of the global market place and that could include higher freight rates in 2024.

Early Peak Season Orders

Jensen noted that an added problem is that some shippers are ordering for peak season very early. They are concerned about the longshore labor talks on the East and Gulf coasts as well as factoring for a possible Canadian railway strike.

On May 22nd, Teamster union rail workers in Canada voted overwhelmingly to authorize a railroad strike. Canadian labor mediators are hoping to head off a strike that could cause serious dislocations to Canada’s freight transportation system, according to a Reuters report.

The early peak season orders might be a temporary problem, but are currently adding to demand for cargo from Asia and contributing to increased volume on Transpacific routes: “Right now, we are seeing a phenomenally early peak season. Importers have rightfully been spooked about the prospects for the peak season here in 2024.”