By Stas Margaronis

The soon to be completed Chinese built port at Chancay, Peru will expedite trade links between Latin American nations and China and have far-reaching implications on Latin America and the United States.

The construction of the Chancay port in Peru will be operated by China Ocean Shipping Company (COSCO). The port will expedite trade links between Latin American nations and China and could reduce dependency on the Panama Canal.

A January 18th, 2024 Reuters report “China widens South America trade highway with Silk Road mega port” noted:

- A decade ago, Peru, the world’s Number 2 copper producer, traded slightly more with the United States than China. Now, China has a more than $10 billion lead in bilateral trade, the latest annual data show.

- That trend is playing out around the region.

- Reuters interviewed two dozen officials, business leaders and trade experts, along with an analysis of ten years of trade data, revealing how China’s infrastructure spending is cementing its role as the key trade and investment partner for South America, defying an economic slowdown at home and U.S. warnings about debt trap

- Fast-growing China needs the copper and lithium from South America’s Andes, along with the corn and soy from the plains of Argentina and Brazil.

- China has in the last year upgraded ties with Uruguay and Colombia to “strategic partnerships” – the latter a U.S. ally.

- Argentina’s President Javier Milei, once highly critical of China, has softened his stance since taking office last month, reflecting Beijing’s importance to the crisis-hit economy. China is the top buyer of Argentina’s soy and beef and has an $18 billion currency swap line with the country – which Argentina’s cash-strapped government has tapped to pay its debt.[1]

“It’s part of China’s new Silk Road,” said Mario de las Casas, corporate affairs manager for COSCO Shipping, which holds a 60% stake in the Peruvian port, according Reuters.

The Chancay Port website states that the first stage “will be developed in an area of 141 hectares (341 acres) and includes the construction of an access road interchange from the Pan-American highway to the vehicular foreport, the connection tunnel with the Port Operational Zone and the Entrance Complex. Likewise, in the Operational Zone the maritime approach and maneuvering channels for ships, the shelter breakwater south of Punta Chancay and the first 4 berths will be built in accordance with the following:”

Berths 1 and 2 are part of the Bulk, General Cargo and Rolling Terminal. Berth 1 is a multipurpose dock that will be destined to primarily meet the demand for solid and liquid bulk and rolling cargo. Berth 2 is a dock designed to primarily meet the demand for general cargo and non-containerized loose cargo ships. This berth will also serve Ro / Ro type ships for rolling cargo.

- Berths 3 and 4 are part of the Container Terminal, they will be “specialized docks to serve container ships, they will have modern high-tech equipment for loading, unloading and transfer of containers, storage yards, administrative areas, service areas and the workshops that are required for the efficient operation of the terminal.”

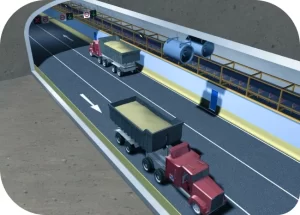

- The underground viaduct tunnel connects the entrance with the Port Operational Zone and “has a length of 1.8 km and constitutes a segregated and exclusive road corridor for cargo traffic related to the port operation. It has 3 vehicular lanes, two conveyor belts for solid bulks and multiproduct pipes for liquid bulks.”[2]

In his book “To Rule the Waves: How Control of the World’s Oceans Shapes the Fate of the Superpowers” author Bruce Jones describes how China expanded its shipbuilding, ocean shipping and domestic and foreign port development that also supported China’s “Belt and Road” initiatives.

Jones is a Senior Fellow at the Brookings Institute; a Washington D.C. think tank. He travelled extensively to China to research his book on the rise of China as a maritime power.

Jones told the Propeller Club of Northern California that the investments China makes in its ports contributes to its leadership in world trade. China’s success includes building up its manufacturing and industrial base resulting in trade surpluses with the United States.

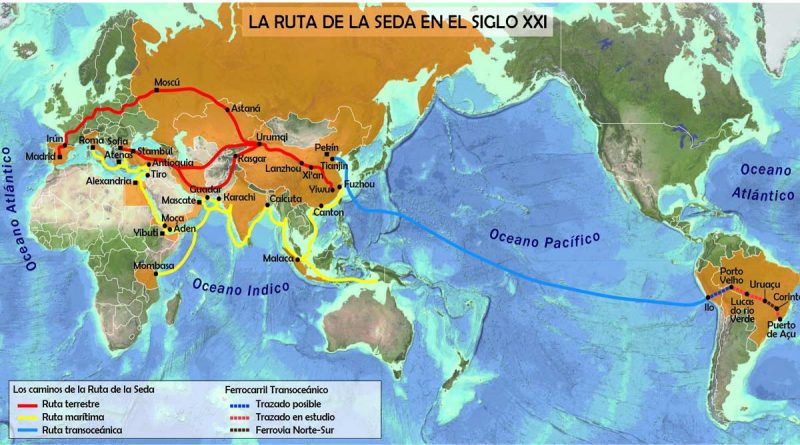

This, in turn, financed a global investment in foreign ports and other infrastructure called the ‘Belt and Road’ initiatives.

Jones’ observations about the effect of China’s ‘Belt and Road’ initiatives can be seen by the example of how China has overtaken the United States as the top trading partner in Latin America.

In a 2023 background report, “China’s Growing Influence in Latin America” the New York headquartered Council on Foreign Affairs (COFA) noted China’s rapid rise in Latin America:

“In 2000, the Chinese market accounted for less than 2 percent of Latin America’s exports, but China’s rapid growth and resulting demand drove the region’s subsequent commodities boom. Over the next eight years, trade grew at an average annual rate of 31 percent … , reaching a value of $180 billion in 2010. By 2021, trade totaled a record $450 billion, a figure that remained largely unchanged in 2022, and some economists predict that it could exceed $700 billion by 2035. China now ranks as South America’s top trading partner and the second-largest for Latin America as a whole, after the United States.”

The COFA report went on to state:

“Latin American exports to China are mainly soybeans, copper, petroleum, oil, and other raw materials that the country needs to drive its industrial development. In return, the region mostly imports higher-value-added manufactured products, a trade some experts say has undercut local industries with cheaper Chinese goods. As of 2023, Beijing has free trade agreements in place with Chile, Costa Rica, Ecuador, and Peru, and twenty-one Latin American countries have so far signed on to China’s Belt and Road Initiative (BRI). (Talks on a free trade agreement with Uruguay are ongoing.)”

Shanghai’s New Yangshan Port Complex

Jones told the Propeller Club of Northern California that China is taking the lead in port development citing the new Yangshan offshore container terminal complex serving Shanghai.

Yangshan is linked to Shanghai by a 30-kilometer bridge (18.6 miles) and helps make Shanghai the largest port in the world.

In 2023, container volume at the Shanghai port exceeded 49 million TEUs an increase of 1.7 million TEUs and an increase of 3.6%. The port complex of Yangshan posted a container volume of 25 million TEUs, an increase of 4.6% year-on-year, accounting for 51% of the total throughput of the Shanghai port last year, according to a report in Seatrade Maritime News.[3]

This compares to 8.6 million TEUs processed through the Port of Los Angeles in 2023, the largest port in the United States.[4]

Jones said the differential between U.S infrastructure spending and China’s larger investments can also be understood in another example.

The infrastructure bill supported by the Biden Administration and enacted into law by Congress in 2021 contained $17 billion for all U.S. ports, according to the Administration’s Port Envoy John Porcari.

The price tag for China building the Yangshan port complex was $18 billion.[5]

China’s Shipbuilding Leadership

Jones notes that China has also become the world’s leader in shipbuilding because shipbuilding is the means to expand trade and maximize the value-added from that trade.

In 2022 China built the lion’s share of large oceangoing vessels according to a report by the Barry Rogriano Salis (BRS) Group. China built 121.3 million deadweight tons (DWT) of ships based on its order book at the end of 2022 up from 111 million DWT in 2021.

And as a result, China’s share of the global shipbuilding market rose from 47.7% to 50.3%.

Meanwhile the United States share of the global shipbuilding marked totaled 0.2%, according to the report.[6]

Jones noted that for the United States “this is a critical time when we are essentially falling out of the shipbuilding business, we are disinvesting in port infrastructure …. we are not in the infrastructure of world trade. China takes over as the infrastructurer of world trade.”

China Ocean Shipping Company (COSCO)

In the 1990s and 2000s, Jones said, China realized how its economy was increasingly dependent on imports of raw materials and in turn, this situation required that it protect its sea lanes through the South China Sea and East China Sea and into Chinese ports.

This has led to China’s expanding its ocean shipping capabilities.

At a time when U.S. container ship carriers such as Sealand and American President Lines have been acquired by foreign flag carriers, China has built up China Ocean Shipping Company (COSCO) to be the fourth largest container carrier in the world.

The huge global reach of COSCO’s maritime operations was detailed by the company on its website at the end of 2023:

“As of Dec 31, 2023, the total fleet of COSCO SHIPPING comprises of 1417 vessels with a total capacity of 116 million DWT (deadweight tons), ranking No.1 in the world. Its container fleet capacity is 3.05 million TEU, ranking the fourth in the world. Its dry bulk fleet (436 vessels/46.32 million DWT), oil tanker fleet (229 vessels/28.58 million DWT) and general and specialized cargo fleet (180 vessels/6.2 million DWT) are all topping the world’s list … The Corporation (COSCO) has invested in 57 terminals globally, including 50 container terminals. The annual handling capacity of its container terminals amounts to 133 million TEU, taking the first place worldwide; the global sales volume of its bunker fuel exceeds 29.99 million tons, which is the largest in the world; with a designed annual production capacity of 1.4 million TEU, the container manufacturing ranks second in the world; and the container leasing business scale reaches 3.80 million TEU, the third-largest in the world … The vision of COSCO SHIPPING is to undertake the mission of globalizing Chinese economy, consolidate advantageous resources, take global shipping.”[7]

The United States Needs to Invest More in Latin America

Jones’s warning about the need for the United States to invest more in its maritime resources and trade is reflected in the growing Investment gap between the United States and China in South and Central America.

The Council on Foreign Affairs (COFA) report makes a similar point: the United States needs to be making a greater investment in Latin America or lose out to China;

“China’s state firms are major investors in the region’s energy, infrastructure, and space industries, and the country has surpassed the United States as South America’s largest trading partner. Beijing has also expanded its diplomatic, cultural, and military presence throughout the region. Most recently, it leveraged its support amid the COVID-19 pandemic, supplying the region with medical equipment, loans, and hundreds of millions of vaccine doses… U.S. President Joe Biden, who sees China as a “strategic competitor” in the region, has pledged greater economic cooperation with Latin America, but some analysts argue the United States should be doing more.”[8]

FOOTNOTES

[1] https://www.reuters.com/world/china/china-widens-south-america-trade-highway-with-silk-road-mega-port-2024-01-18/

[2] https://coscochancay.pe/en/the-project/

[3] https://www.seatrade-maritime.com/ports/shanghai-retains-worlds-busiest-container-port-crown-2023

[4] https://www.ajot.com/insights/full/ai-las-seroka-says-ports-of-la-long-beach-increased-market-share-in-2023

[5] https://www.marineinsight.com/ports/the-yangshan-deep-water-port-the-biggest-deep-water-port-in-the-world/

[6] https://www.ajot.com/insights/full/book-review-ships-for-victory-how-the-us-pioneered-the-mass-production-of-ships

[7] https://en.coscoshipping.com/col6918/art/2016/art_6918_45339.html

[8] https://www.cfr.org/backgrounder/china-influence-latin-america-argentina-brazil-venezuela-security-energy-bri

https://dialogo-americas.com/articles/chinas-chancay-port-runs-into-problems/

https://rbtus.com/does-china-rule-the-waves-a-review-of-to-rule-the-waves-by-bruce-jones/

https://www.oboreurope.com/en/cosco-peru-chancay/