BY STAS MARGARONIS

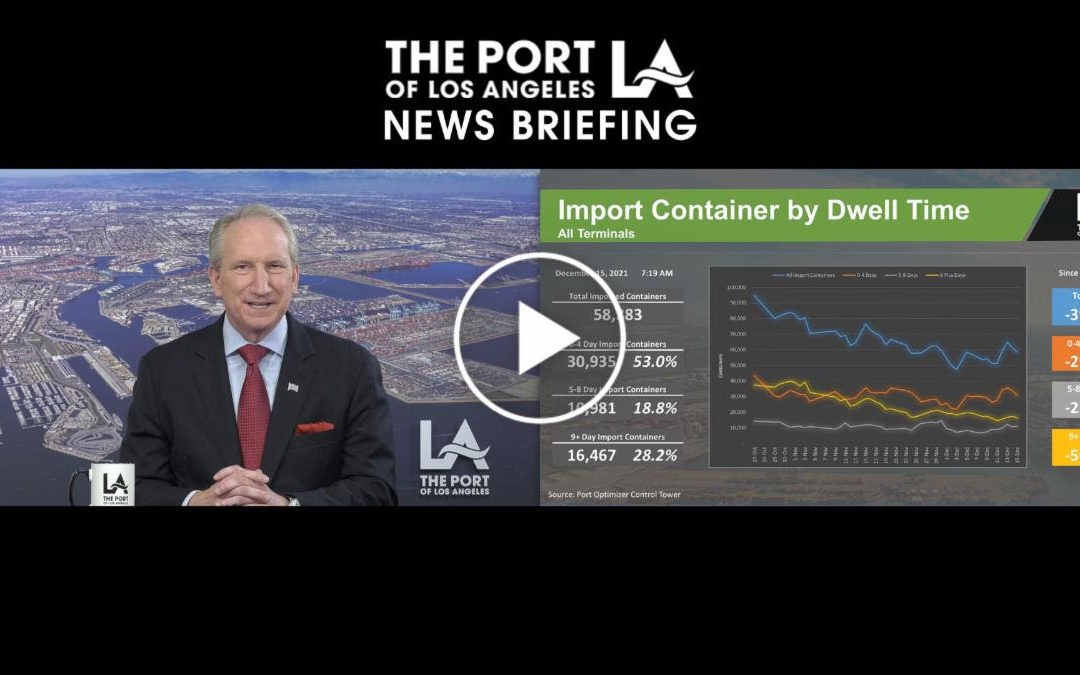

As the backlog of import containers at container terminals has declined, Eugene Seroka, executive director Port of Los Angeles, said the Port is turning its attention to the backlog of empty containers and may impose fees on empty containers that dwell on terminals “excessively.”

Backlog of Empty Containers

Speaking at the Port’s media briefing on December 15th, Seroka said the backlog of empty containers has become a serious problem that container shipping lines need to address:

“ We will look at alternatives including levying fees against liner companies for empty containers that dwell excessively on our marine terminals …. currently 60% of all empty containers have been lingering 9 days or longer.”

Seroka explained: “Nearly 71,000 empty containers are located on Port terminals and Port property. We are imploring liner shipping companies to bring in more and larger sweeper vessels to clear out these empty containers.”

Chassis Shortage

Seroka said there is also a shortage of chassis needed for trucks to move containers on and off marine terminals:

“The chassis on the ground have been modeled on a 3.5-day street dwell time. Right now … that dwell time is up to 10 days. For every incremental day a chassis is out on the street we need to inject another 3,500 units per day so that it is safe to say that within the current environment we would need between 25,000 – 27,000 additional chassis just to keep the supply chain fluid”

The Port has been working with the Biden Administration on a number of issues including the chassis shortage: “we’ve been working with the Administration to alleviate supply chain breakpoints and chassis are one of those. So, speeding up the velocity and getting containers off the terminal quicker, getting them devanned into the warehouses and bringing those assets back to the Port is the best way to improve chassis inventory…”

The problem of chassis availability is partly complicated by tariffs on steel products that were imposed under the Trump Administration. The imposition of tariffs on steel products has slowed U.S. chassis production with the result that: “it’s been difficult to get those assets into the U.S. and on the ground to port communities.”

Having the Biden Administration order a Defense Production Act mobilization of U.S. chassis production was “a great question for the Administration,” he said.

Seroka said that getting U.S. chassis producers to increase production was essential because orders for new chassis are currently backed up into 2022 and 2023: “There needs to be trade policy, diplomacy and looking at these chassis manufacturers to step up production.”

Positive and Negative Indicators

In other Port of Los Angeles news, Seroka reported:

- Rail dwell times “are down from 13 days this summer to 2 days, the lowest since pre-pandemic times … great improvement.”

- Street dwell time, the time it takes a chassis and container to leave the marine terminal and return back is now at a high of 10 days. “That needs immediate attention to bring that number below 4 days as it was pre-surge.”

While final container figures are pending for November 2021 Seroka reported provisional figures for 2021:

- Year to date container volume at the Port is up 18.7% over 2020 totaling 9,891, 267 twenty-foot unit containers (teus). This is based on November 2021 data.

- The number of empty containers waiting to be transported off Port property and back on to container ships rose 11% in November 2021 compared to November 2020. The 2021 November total was 325,838 teus.

- Imports declined 13.2% in November 2021, compared to November 2020 totaling 403,569 teus.

- Loaded exports declined by 37% in November 2021 compared to November 2020 totaling 82,298 teus.